After a pandemic-induced lull, high-net-worth individuals (HNWIs) are once again on the move, seeking new homes and opportunities around the globe. A recent report by Henley & Partners, a global citizenship and investment advisory firm, reveals the top destinations for these wealthy individuals, as well as the countries experiencing an exodus of their richest residents.

The report, titled "Private Wealth Migration Report 2023," tracks the migration patterns of HNWIs, defined as individuals with a net worth of at least $1 million USD. According to the report, an estimated 122,000 HNWIs are expected to move to a new country by the end of 2023.

View this post on Instagram

The Top Destinations for Millionaires

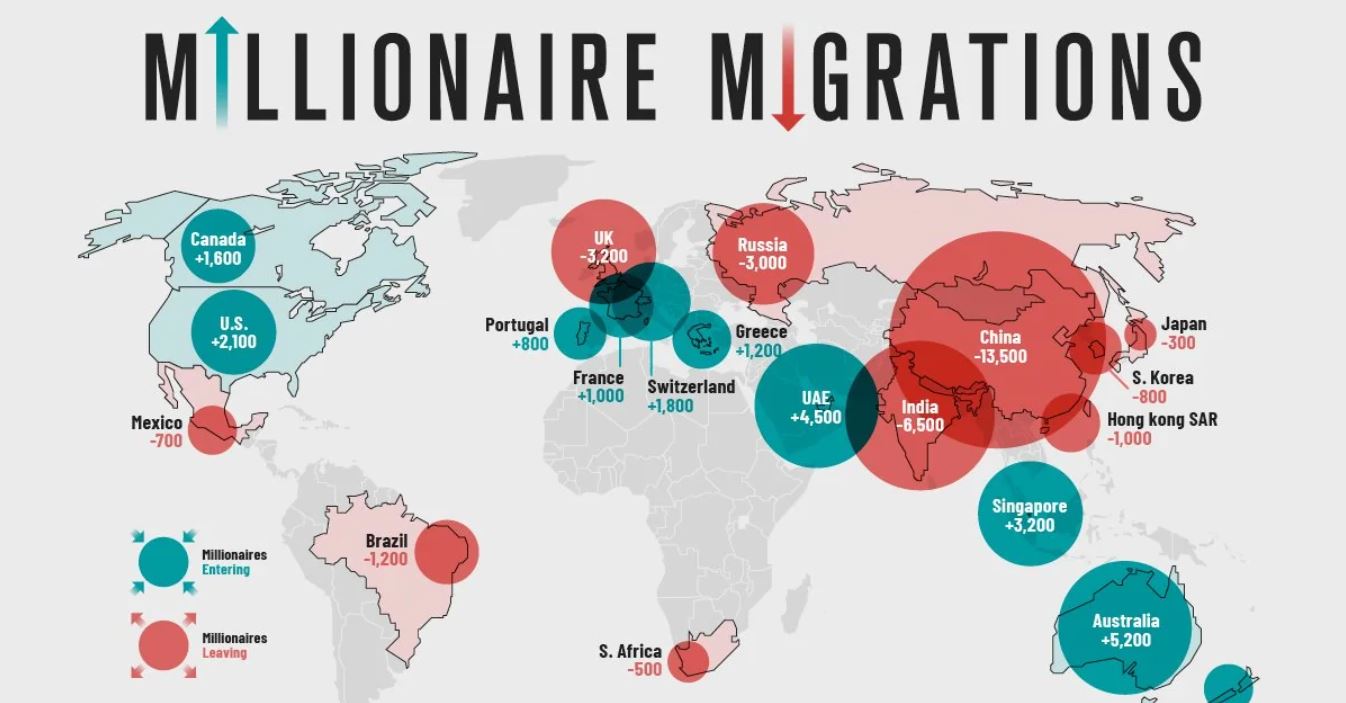

Australia reclaims its top spot as the most attractive destination for millionaires this year, with an expected influx of 4,000 HNWIs. The United Arab Emirates (UAE), which held the top spot in 2022, slips to second place, anticipating the arrival of 3,500 wealthy individuals.

The remaining top 10 destinations are scattered across Europe, North America, and Oceania, reflecting the diverse preferences of HNWIs. These countries include Canada (3,200), Singapore (3,200), the United States (3,000), Israel (2,500), Switzerland (2,400), Portugal (2,000), New Zealand (2,000), and Greece (1,200).

Factors Driving Millionaire Migration

Several factors contribute to the decision of HNWIs to relocate, including economic opportunities, political stability, quality of life, and tax considerations. Many of the leading millionaire destinations offer favorable tax regimes and ease of investment, making them attractive havens for wealth preservation and growth.

For instance, Singapore, which expects to gain 3,200 millionaires, is renowned for its business-friendly environment and low tax rates. Similarly, Greece's golden visa program, which grants residency and eventually EU passports for a real estate investment of €250,000, has been a major draw for wealthy individuals seeking a gateway to Europe.

Countries Losing High-Net-Worth Individuals

While some countries are welcoming an influx of millionaires, others are witnessing an outflow of their wealthiest residents. China is projected to lose 13,500 HNWIs this year, the highest number among all countries. India follows closely behind, anticipating a loss of 6,500 millionaires.

Several factors contribute to this outflow, including political and economic instability, regulatory challenges, and restrictions on wealth management. In Russia, many wealthy individuals face personal sanctions and trade restrictions due to the war in Ukraine. China's crackdown on Hong Kong has dampened business sentiment, while the UK's exit from the EU has created uncertainty for cross-border investments.

The Impact of Millionaire Migration

The net migration of HNWIs has significant economic implications for both gaining and losing countries. Countries that attract wealthy individuals often experience increased investment, job creation, and tax revenue. Conversely, those losing millionaires may face reduced economic activity and a decline in their tax base.

Overall, the report highlights the growing trend of millionaire migration, driven by individuals seeking to optimize their personal and financial well-being. As geopolitical landscapes continue to evolve and technology facilitates global mobility, we can expect to see this trend continue in the years to come. Governments around the world will need to adapt their policies and strategies to attract and retain HNWIs, recognizing their potential contributions to economic growth and prosperity.

News Source: visualcapitalist.com